xInvoice

What are xInvoices?

An xInvoice is a special type of electronic invoice.

An electronic invoice is an invoice that is sent to a business partner as a file / electronic document which has the same content and legal status as a paper invoice. Electronic invoices are a way of simplifying the invoicing process within a company and in public bodies.

Companies that send invoices to public bodies have been required to submit invoices in the xInvoice format since 11.27.2020. Paper invoices are no longer accepted by public bodies from this time onwards.

If you use the latest version of eserp, the latest xInvoice CII![]() CII stands for C Industry Invoice and is an XML syntax used in electronic invoices. It is used for standardized electronic data exchange. The CII syntax is, for example, also a part of the electronic procurement process.

There are two main electronic invoicing formats used in Germany: XRechnung and ZUGFeRD. The XRechnung format supports both CII and UBL, whereas ZUGFeRD only supports CII. format will be used.

CII stands for C Industry Invoice and is an XML syntax used in electronic invoices. It is used for standardized electronic data exchange. The CII syntax is, for example, also a part of the electronic procurement process.

There are two main electronic invoicing formats used in Germany: XRechnung and ZUGFeRD. The XRechnung format supports both CII and UBL, whereas ZUGFeRD only supports CII. format will be used.

Electronic document delivery in eserp

It has previously been possible to use electronic document delivery in eserp to send invoices digitally. xInvoice has been added as a further format. If you have already used electronic document delivery in eserp, you will only see a few changes when you use the xInvoice format.

As part of the addition of the xInvoice format, the following chnges have been made to electronic document delivery:

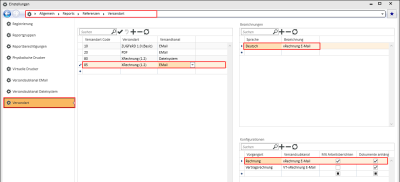

The following Delivery types under Settings | General | Reports | References | Delivery type have been renamed:

ZUGFeRD Basic -> ZUGFeRD 1.0 Basic

ZUGFeRD Comfort -> ZUGFeRD 1.0 Comfort

ZUGFeRD Extended -> ZUGFeRD 1.0 Extended

The following new delivery types have been added:

ZUGFeRD 2.1 Minimum

ZUGFeRD 2.1 BasicWL

ZUGFeRD 2.1 Basic

ZUGFeRD 2.1 EN16931 (Comfort)

ZUGFeRD 2.1 Extended

XRechnung 1.2

Also see Delivery type

The ZUGFeRD profiles ZUGFeRD 2.1 Minimum and ZUGFeRD 2.1 BasicWL do not represent a valid invoice according to German Law.

Also see ZUGFerd profiles

xInvoice requirements

- To use xInvoice, an update of eserp to at least Version 1.0.14.4 is required.

- Run the database script Update_XRechnung.sql (MS SQL or Firebird)

- Adjust / add the Edifact quantity units.

- Record own bank account, own tax number, and VAT ID number.

- Configure the Delivery subchannel (file system or email) and Delivery type.

- Settings in client master data (public authorities)

Adjust / add the Edifact quantity units.

Units of quantity from the UN/CEFACT Recommendation 20 table are used in electronic document transmission (invoices, purchase orders, eswawi, etc.).

The corresponding abbreviation must be entered in the Units of quantity according to Edifact column under Settings | Items | Item references | Units of quantityUnit of quantities.

Also see Unit of quantities

Units of quantity according to Edifact

Important units of quantity are, for example:

|

Unit of quantities |

Meaning |

Unit of quantity according to Edifact |

|---|---|---|

|

% |

Percent |

P1 |

|

No. |

Number of items |

NAR |

|

kg |

Kilogram |

KGM |

|

km |

Kilometer |

KTM |

|

kWh |

Kilowatt-hour |

KWH |

|

l |

Liter |

LTR |

|

m |

Meter |

MTR |

|

m2 |

Square meter |

MTK |

|

m3 |

Cubic meter |

MTQ |

|

min |

Minute |

MIN |

|

mm |

Millimeter |

MMT |

|

mm2 |

Square millimeter |

MMK |

|

Flatrate |

Flat rate |

LS |

|

Pr. |

Number of pairs |

NPR |

|

Set(s) |

Set |

SET |

|

Pcs. |

One (piece) |

C62 |

|

Pce. |

One (piece) |

C62 |

|

Hr |

Hour |

HUR |

|

Piece |

One (piece) |

C62 |

|

t |

Metric ton |

TNE |

|

Day(s) |

Day |

DAY |

|

Week(s) |

Week |

WEE |

Source CEN MUG based on UN/CEFACT Recommendation 20

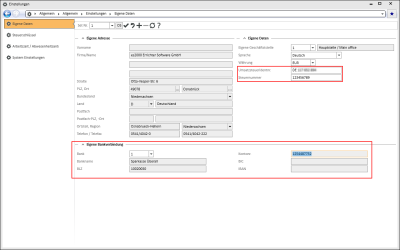

Bank account, Tax number, and VAT ID number

The following references are required to create an xInvoice. The bank account is used for the client's payment receipt.

- Record your own bank account under Settings | Book keeping | Transactions | References | Bank accounts using a valid IBAN and BIC.

- Assign this bank account to your own company / office branch (Settings | General | General | Settings | Own data - 'Own bank account' area).

-

Enter the VAT ID number and Tax number under Settings | General | General | Settings | Own data - 'Own data' area.

Settings sets

If you are using several Settings sets (for example, when using office branches), the VAT ID number and Tax number must be recorded for each settings set.

Also see Bank accounts and Own data.

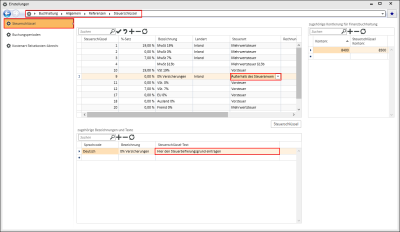

Tax code settings

It is necessary to transmit corresponding codes in the tax codes of an xInvoice by means of the Tax type in cases where the tax differs if 0% VAT is stated in an invoice.

The tax codes can be edited under Settings | Book keeping | General | References | Tax code.

The following Tax types are available:

-

Value added tax

-

VAT §13b

-

Prepaid tax

-

Goods taxable at zero rate

(The value added tax rate is 0.00%)

-

Tax free

(VAT / IGIC / IPSI)

Code according to UNTDID 5305 6: E (Exempt from tax)

-

Tax free for intra-community supply of goods

(the rules for reversal of tax liability for VAT / IGIC / IPSI apply)

Code according to UNTDID 5305 6: AE (VAT Reverse Charge)

-

Free export item

VAT / IGIC / IPSI not imposed due to regulations for intra-community supplies)

Code according to UNTDID 5305 6: K (VAT exempt for EEA intra-community supply of goods and services)

-

Services rendered outside the area where tax applies

(VAT / IGIC / IPSI does not apply to sale)

Code according to UNTDID 5305 6: C (Duty paid by supplier)

-

Canary Islands general indirect tax

(IGIC tax applies)

Code according to UNTDID 5305 6: L (Canary Islands general indirect tax)

-

IPSI (tax for Ceuta / Melilla)

(IPSI tax applies)

Code according to UNTDID 5305 6: M (Tax for production, services and importation in Ceuta and Melilla)

The descriptions are taken from the specifications for xRechnung_CII. Selection of the tax types other than VAT, VAT §13b, and prepaid tax is only required for the corresponding application cases (for example xInvoice with 0.00% VAT) and can otherwise be disregarded.

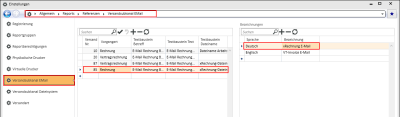

Configure Delivery subchannel and Delivery type

The Delivery channel specifies whether the xInvoice is to be sent by email or saved in the file system for transmission to an online portal. You can record both delivery subchannels (file system / email) with a corresponding delivery type.

The client can be assigned a delivery type depending on the requirements.

Create delivery subchannel

Delivery subchannel file system

Channel of delivery Email

Configure a delivery channel for sending xInvoices by email under Settings | General | Reports | References | Delivery subchannel email.

Also see Delivery subchannel email

Configure delivery type

The delivery type specifies the format (PDF, xInvoice, ZUGFeRD etc.) and the delivery type (email/ storage in file system).

Example of a delivery type with storage of output in the file system

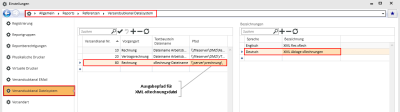

Example of a delivery type for sending by email

Also see Delivery type

Settings in client master data (public authorities)

As xInvoices can be presented in various ways, a Client ID / Routing ID is needed for unique identification.

The routing ID enables addressing and, if required, forwarding of received electronic invoices to the corresponding public sector clients regardless of the transmission path.

You can find information about the format of the Routing ID at:

A valid VAT ID no. (value added tax identification number) and a Client ID no. (routing ID) is required for each client on the Office | Clients | InvoiceInvoice tab in order to send xInvoices.

A different Routing ID than the Client routing ID can be specified for a process (for example, for Contracts) or when booking invoices.

The Routing ID of an invoice recipient is normally transmitted to the invoicing party or invoice sender in the actual order. Please contact the public client if you do not have the Routing ID for an order.

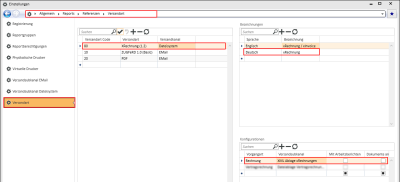

Specify document delivery

Document delivery must be configured for every client who is to receive xInvoices.

-

Select the Configuration | Document delivery command in the Navigation toolbar for the corresponding Client (Office | Clients | Address).

-

Create an entry for the Process type Invoice and assign the Delivery type code for xInvoices to it. Select the desired Delivery channel.

If required, you can also create an entry for Contract invoices.