xInvoice without email transmission

It is not always necessary to send an xInvoice to the client by email. Sometimes it is necessary to save the XML file of an xInvoice to the client's online portal.

Settings required

The following instructions describe the necessary settings that need to be made before using the xInvoice function in eserp.

Bank account, Tax number, and VAT ID number

The following references are required to create an xInvoice. The bank account is used for the client's payment receipt.

- Record your own bank account under Settings | Book keeping | Transactions | References | Bank accounts using a valid IBAN and BIC.

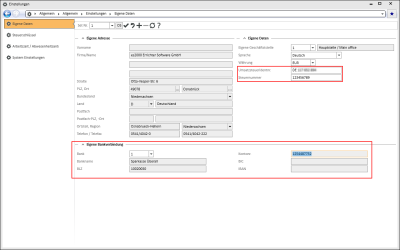

- Assign this bank account to your own company / office branch (Settings | General | General | Settings | Own data - 'Own bank account' area).

-

Enter the VAT ID number and Tax number under Settings | General | General | Settings | Own data - 'Own data' area.

Settings sets

If you are using several Settings sets (for example, when using office branches), the VAT ID number and Tax number must be recorded for each settings set.

Also see Bank accounts and Own data.

Create text category / text module

-

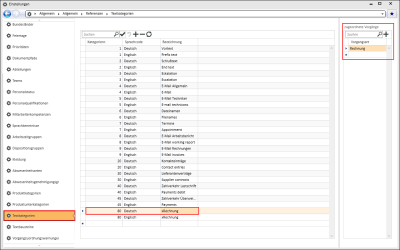

Create a text category called xInvoice under Settings | General | General | Text categories and assign the Invoice process to it.

-

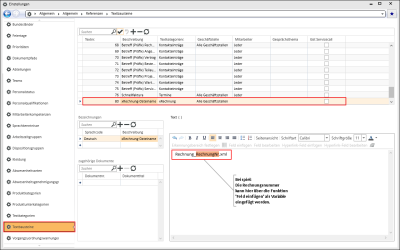

Create a text module for the file name of the xInvoice under Settings | General | General | Text modules module and assign the Text category xInvoice to it.

Also see Text categories and Text modules.

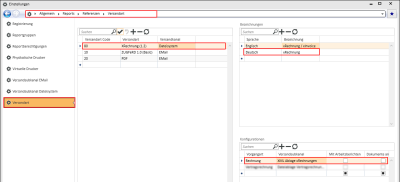

Create delivery channel

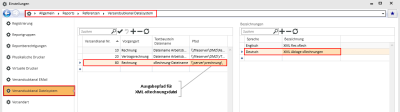

- Configure a delivery channel for storing the XML files for the xInvoices under Settings | General | Reports | References | Delivery subchannel file system.

-

Assign the Invoice Process type to the new entry and select the Text module for the xInvoice file name. Enter the directory where the XML files for the xInvoices are to be saved under Path.

Also see Delivery subchannel file system

Define delivery type for xInvoices

-

Create a new delivery type for xInvoices under Settings | General | Reports | References | Delivery type.

Delivery type: xInvoice (1.2)

Delivery channel: File system

-

Create an entry in the Configurations area for the Delivery type with Process type Invoice and the Delivery subchannel (see Create delivery channel).

If required, you can also create an entry for Contract invoices.

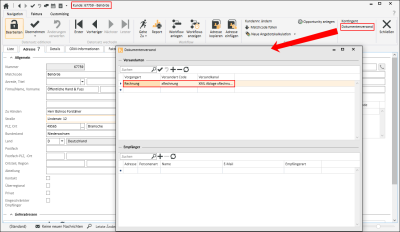

Settings in client master data (public authorities)

Document delivery must be configured for every client who is to receive xInvoices via an online portal.

-

Select the Configuration | Document delivery command in the Navigation toolbar for the corresponding Client (Office | Clients | Address).

-

Create an entry for the Process type Invoice and assign the Delivery type code for xInvoices to it. Select File system as the Delivery channel.

If required, you can also create an entry for Contract invoices.

-

A valid VAT ID no. (value added tax identification number) and a Client ID no. (routing ID) is required for each client on the Office | Clients | Invoice tab in order to send xInvoices.

The Routing ID of an invoice recipient is normally transmitted to the invoicing party or invoice sender in the actual order. Please contact the public client if you do not have the Routing ID for an order.

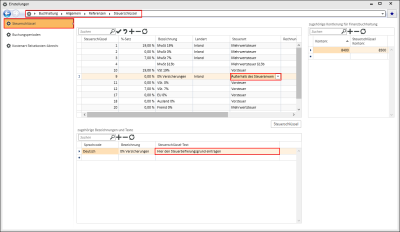

Tax code settings

It is necessary to transmit corresponding codes in the tax codes of an xInvoice by means of the Tax type in cases where the tax differs if 0% VAT is stated in an invoice.

The tax codes can be edited under Settings | Book keeping | General | References | Tax code.

The following Tax types are available:

-

Value added tax

-

VAT §13b

-

Prepaid tax

-

Goods taxable at zero rate

(The value added tax rate is 0.00%)

-

Tax free

(VAT / IGIC / IPSI)

Code according to UNTDID 5305 6: E (Exempt from tax)

-

Tax free for intra-community supply of goods

(the rules for reversal of tax liability for VAT / IGIC / IPSI apply)

Code according to UNTDID 5305 6: AE (VAT Reverse Charge)

-

Free export item

VAT / IGIC / IPSI not imposed due to regulations for intra-community supplies)

Code according to UNTDID 5305 6: K (VAT exempt for EEA intra-community supply of goods and services)

-

Services rendered outside the area where tax applies

(VAT / IGIC / IPSI does not apply to sale)

Code according to UNTDID 5305 6: C (Duty paid by supplier)

-

Canary Islands general indirect tax

(IGIC tax applies)

Code according to UNTDID 5305 6: L (Canary Islands general indirect tax)

-

IPSI (tax for Ceuta / Melilla)

(IPSI tax applies)

Code according to UNTDID 5305 6: M (Tax for production, services and importation in Ceuta and Melilla)

The descriptions are taken from the specifications for xRechnung_CII. Selection of the tax types other than VAT, VAT §13b, and prepaid tax is only required for the corresponding application cases (for example xInvoice with 0.00% VAT) and can otherwise be disregarded.

Booking / issuing an xInvoice

No print or email dialog is displayed when an invoice is booked in a calculation folder for a client for whom document delivery has been set to xInvoice with file save. The invoice document (XML file) will be saved directly to the previously specified output folder and can be further used from there, for example uploaded to the online portal of a public authority. The file name is determined by the text module (see Create text category / text module).

As the invoice file is generated and saved directly, it is also possible to process contract invoices in serial invoicing with the associated settings.

The invoice must be assigned to a Salesperson, either via the calculation folder or the contract.